32+ deduction for mortgage interest

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. Web So if your first and second mortgages have balances over 750000 you can deduct interest on only the first 750000 of those.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Web Most homeowners can deduct all of their mortgage interest.

. Web In 2018 less than 4 percent of taxpayers earning less than 50000 will claim the deduction and these taxpayers will receive less than 1 percent of the tax. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. 16 2017 then its tax-deductible on mortgages.

Web If youve closed on a mortgage on or after Jan. Web If you want to deduct your mortgage interest youll have to itemize. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. That assumes youre married.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Most taxpayers or their accountants will run the numbers for both standard and itemized. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web The mortgage interest deduction is one of the most popular tax deductions claimed by an estimated 323 million people in 2017. For tax year 2023.

However higher limitations 1 million 500000 if married. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web MORTGAGE INTEREST DEDUCTION.

Discover Helpful Information And Resources On Taxes From AARP. Web Answer a few questions to get started. Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Compare offers from our partners side by side and find the perfect lender for you.

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves

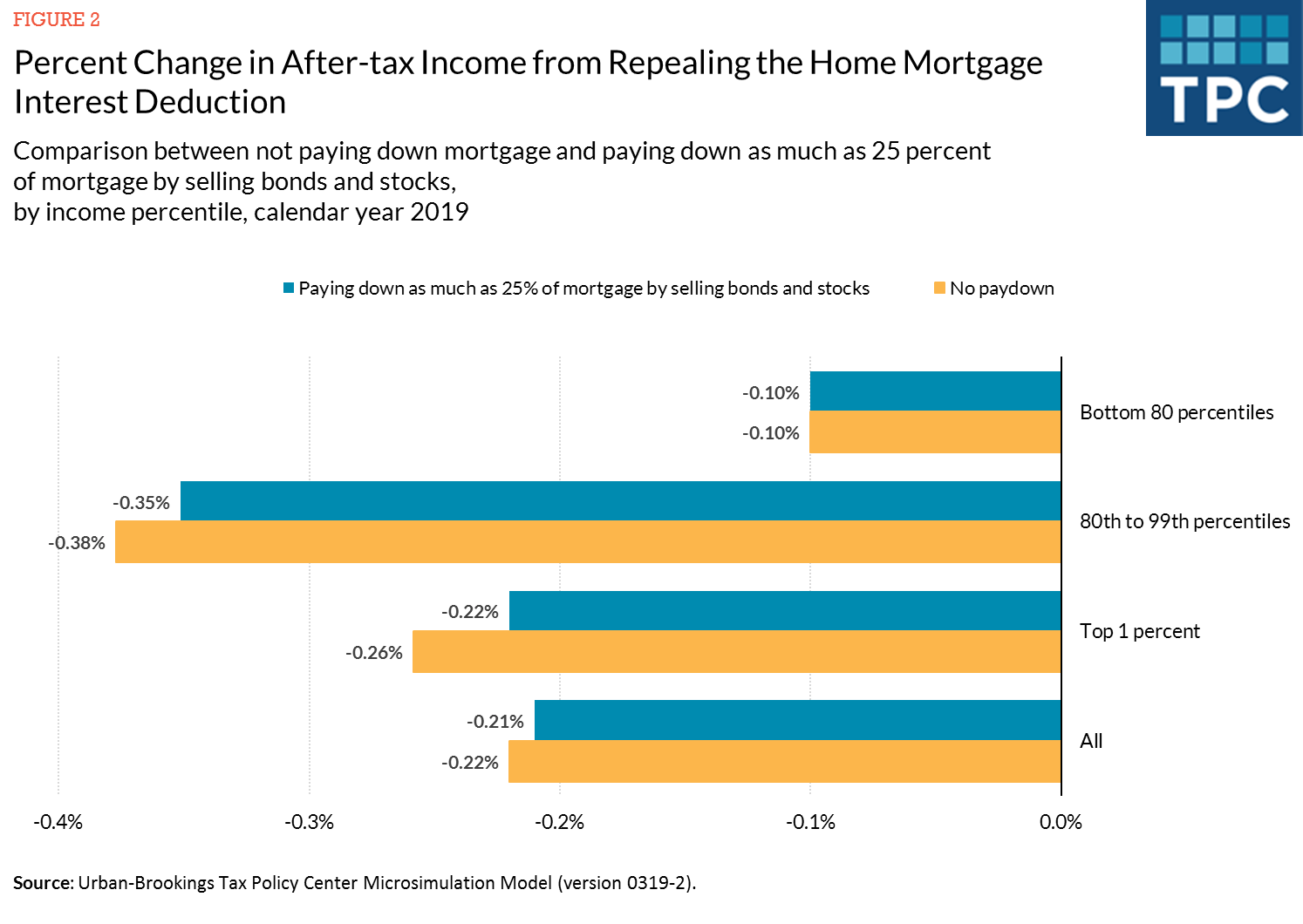

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Home Buying Tax Deductions Real Estate Tax Reductions

How Lenders Calculate Mortgage Interest Rates Mortgagehippo

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Rules Limits For 2023

Maximum Mortgage Tax Deduction Benefit Depends On Income

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Mortgage Interest Deduction Changes In 2018

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Economist S View Health Care Costs And The Tax Burden In The Us And Europe

New Mortgage Interest Deduction Rules Evergreen Small Business

Mortgage Interest Deduction A 2022 Guide Credible